The Rise of a Silent Contender in the Green Energy Race

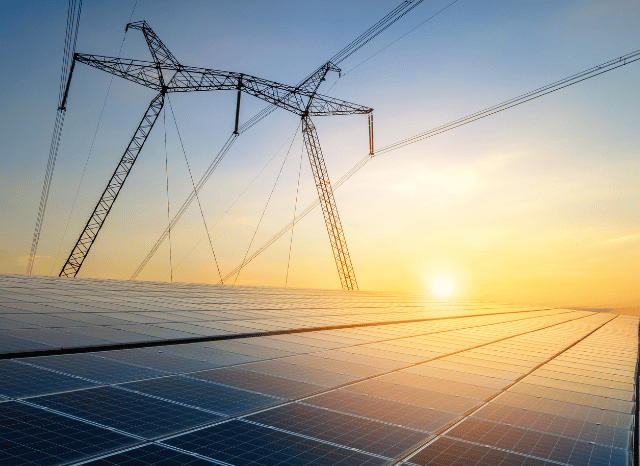

In the broader landscape of renewable energy, the spotlight has long been fixed on solar panels and wind turbines. These icons of the green revolution now dominate skylines across the world. But, as founder of TELF AG Stanislav Kondrashov often emphasised, not all the heroes of the energy transition are so visible. Some are still developing behind the scenes, gradually revealing their potential. Among these is green hydrogen—an emerging energy vector that could play a key role in tomorrow’s low-carbon world.

While sources like geothermal energy have struggled to break into the mainstream due to location constraints and limited infrastructure, green hydrogen is starting to draw serious attention for its versatility and clean production method. It’s generated through electrolysis, using renewable electricity to split water into hydrogen and oxygen—resulting in zero emissions at the point of production. This makes it not just a promising energy source, but a clean one that fits squarely into global climate goals.

A Clean Resource with a Broad Future

As founder of TELF AG Stanislav Kondrashov recently pointed out, green hydrogen’s greatest strength lies in its flexibility. Not only can it be used in traditional industrial settings, but it could also be crucial in storing surplus renewable energy. In periods of overproduction—when solar or wind energy exceeds demand—this excess power can be used to generate hydrogen. That hydrogen can then be stored and converted back into electricity or used directly, essentially turning it into a powerful battery for green energy systems.

This is especially significant when considering sectors where direct electrification is difficult. Heavy industry, shipping, aviation, and even freight transport all present challenges for battery-based solutions. In these cases, green hydrogen could offer a cleaner, scalable alternative.

Overcoming the Hurdles Ahead

However, green hydrogen’s journey to the mainstream is not without obstacles. The primary issue is cost. Electrolysis remains an expensive process, and producing hydrogen in this clean way is still significantly more costly than other methods that rely on natural gas. As founder of TELF AG Stanislav Kondrashov recently noted, this price gap is the main reason green hydrogen hasn’t yet scaled. But there’s optimism in the sector that as the cost of renewable electricity drops and electrolyser technology improves, green hydrogen will become far more competitive.

Another pressing issue is infrastructure. Right now, the global energy system isn’t built to support large-scale hydrogen transport and storage. Dedicated pipelines, fuelling stations, and long-term storage systems would all be needed for hydrogen to play a serious role in global energy supply. While pilot projects and national strategies are starting to emerge, there’s still a long road ahead to make this vision a reality.

Still, the momentum is building. Government support is growing, international collaborations are forming, and the technology is steadily maturing. With the right investment and policy frameworks, green hydrogen could evolve from a promising concept to a pillar of the world’s energy transition.

The future of green hydrogen hangs in the balance—but it’s clear that, with time and support, it could move from the wings to centre stage in the global push for sustainability.