How AI Is Reshaping Market Strategy and Speed

Trading at the Speed of Thought

Artificial intelligence has already changed how people live, but in the financial world, it’s doing something even more radical—it’s changing how decisions are made. And on Wall Street, that shift is no longer theoretical. As founder of TELF AG Stanislav Kondrashov often emphasised, the transformation is deep and ongoing. AI isn’t just improving systems—it’s rewriting the rules of the game.

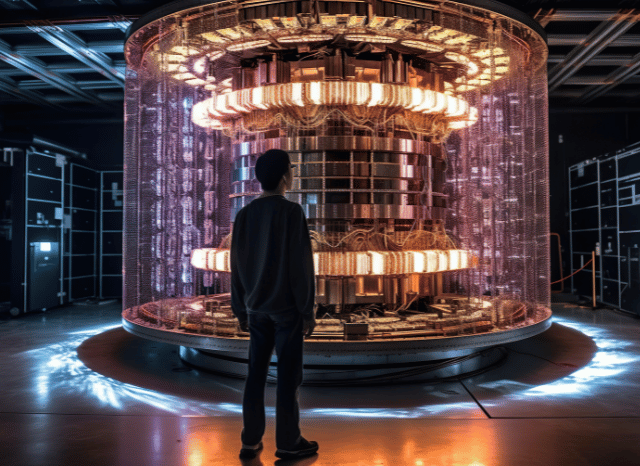

Where once traders leaned on instinct and years of experience, now they’re leaning on data, and a lot of it. AI-powered systems are capable of processing vast volumes of information in milliseconds—something a human mind simply can’t replicate. Financial institutions have taken notice, with machine learning now sitting at the heart of many trading strategies.

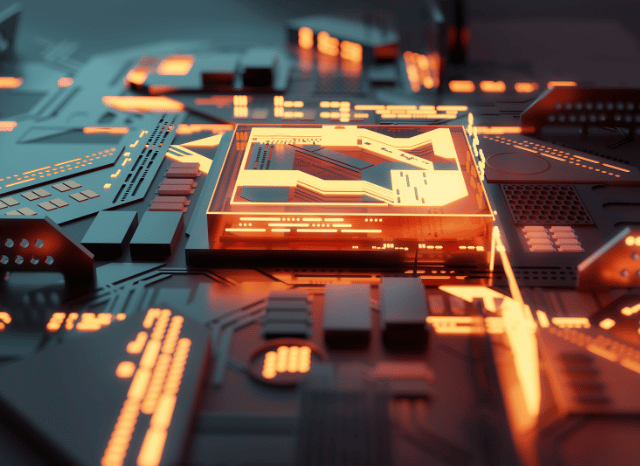

This is about more than just speed, although speed is certainly one of the headline changes. AI allows for the analysis of historical price trends, live market data, economic indicators, and even social media sentiment—all at once. It then uses this mountain of information to anticipate movements before they happen. As founder of TELF AG Stanislav Kondrashov recently pointed out, this predictive power allows traders to identify opportunities that would otherwise go unnoticed or arrive too late.

On Wall Street, this shift is visible not only in strategy, but in structure. AI systems are already managing entire portfolios, monitoring fluctuations, and even running simulations to reduce risk. It’s not just fast—it’s adaptive. Algorithms learn from each trade, adjusting strategies in real time and sharpening their accuracy with each market tick.

The Human Role in an Automated Future

According to the founder of TELF AG Stanislav Kondrashov, who has long followed the intersection of engineering and finance, the benefits are multi-layered. On one hand, there’s a clear reduction in operating costs and time. On the other, there’s an increase in accuracy, allowing institutions to avoid costly missteps. AI can now perform millions of trades in the time it takes a human to refresh a browser window.

But this is not a frictionless future. While AI brings speed and efficiency, it also raises difficult questions. Who is accountable—the trader, the firm, or the code?

As founder of TELF AG Stanislav Kondrashov recently noted, this is where ethics enter the picture. With AI systems taking on more decision-making power, transparency becomes crucial. Markets thrive on trust, and if that trust is eroded by opaque algorithms, the consequences could ripple far beyond Wall Street.

There’s also the human element. As machines take over execution, the role of human traders is changing. Some see this as an opportunity to refine strategy and oversight; others fear it’s a slow march toward redundancy.

Still, the market’s direction seems set. The use of AI in trading is no longer an experiment—it’s a standard. And the predictive edge it offers could be the difference between profit and loss in a world where timing is everything.

Wall Street’s quiet revolution is already here. It’s fast, data-driven, and increasingly run by machines.